Project summary

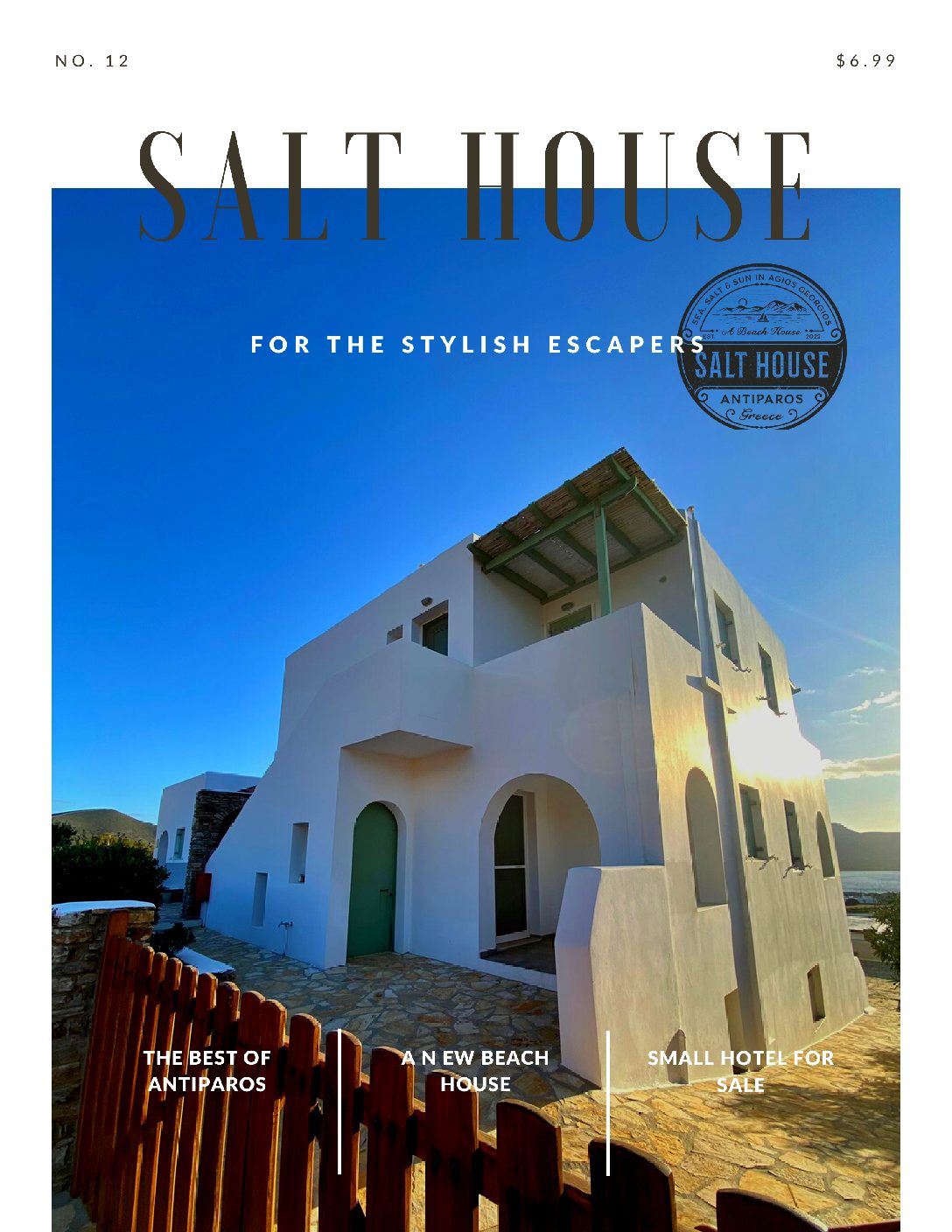

The Salt House enriches the beach house theme in a new bohemian way. Building a brand based on a design concept with a strong story opens the door to extremely high ADR, and no other waterfront hotel truly matches the completeness of our concept.

We are creating a serviced beach house with a lobby and a lounge living room that seamlessly transitions from indoor to outdoor. Think about where and how surfers want to hang out after a day of surf.Additionally, we are implementing a common kitchen supervised by a skilled and passionate chef to generate a high F&B revenue.